Social Insurance Administration: Medical- and rehabilitation allowance

How is my payment entitlement calculated in the new system?

Full payments and income thresholds from September 1st will be as follows - see here.

The impact of income is 45% after the income threshold has been reached. Please note that in accordance with the new system, the payment categories of sickness and rehabilitation payments and household supplement are combined, if applicable, and then 45% of income exceeding the income threshold is deducted from that amount. Therefore, one total sum appears in the payment plan.

Example:

An individual eligible for household supplement.

Employment income: 200,000 krona per month.

Capital income (interest on deposits): 10,000 krona per month

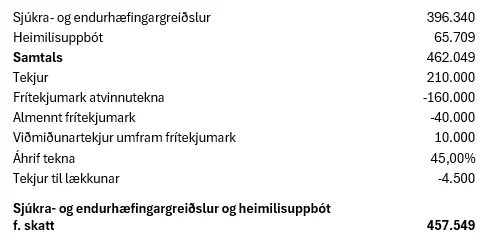

Their payment entitlement in the new system is:

As can be seen in the example above, employment income is 200,000 krona and capital income is 10,000 krona per month. The income threshold for employment income is 160,000 kr. which is deducted, and the general income threshold is 40,000 kr. which is also deducted. Therefore, the reference income exceeding the income thresholds is 10,000 kr. From this amount, a 45% reduction is calculated, which amounts to 4,500 krona. The total payment before reduction is 462,049 krona. From this, 4,500 krona is deducted, so the sickness and rehabilitation payments and household supplement total 457,549 krona.